The Ultimate List of RBI Governors:

Past to Present

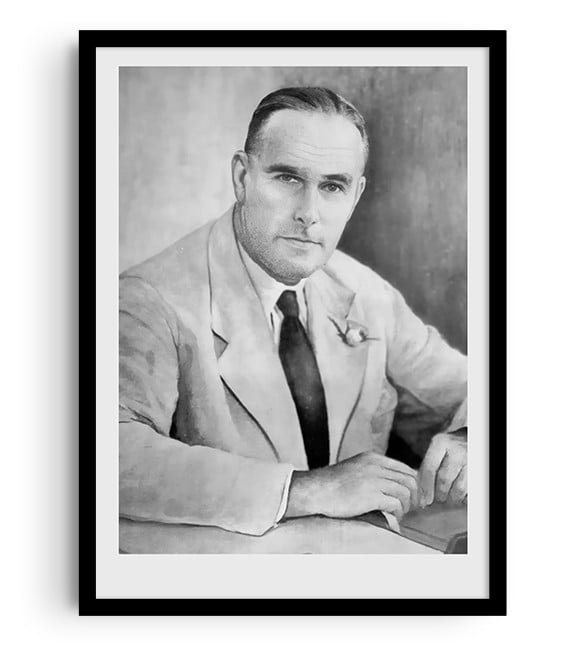

Osborne Smith

1935 - 1937

Background:

The inaugural Governor of the RBI, Sir Osborne Smith was a British banker who previously served as the Managing Governor of the Imperial Bank of India.

Key Contributions:

He played a pivotal role in setting up the central banking system in India.

James Braid Taylor

1937- 1943

Background:

An Indian Civil Services officer, Sir James Braid Taylor had served as the Controller of the Currency and Deputy Governor of the RBI before becoming Governor.

Key Contributions:

His tenure was marked by efforts to stabilize the Indian economy during the pre-independence era.

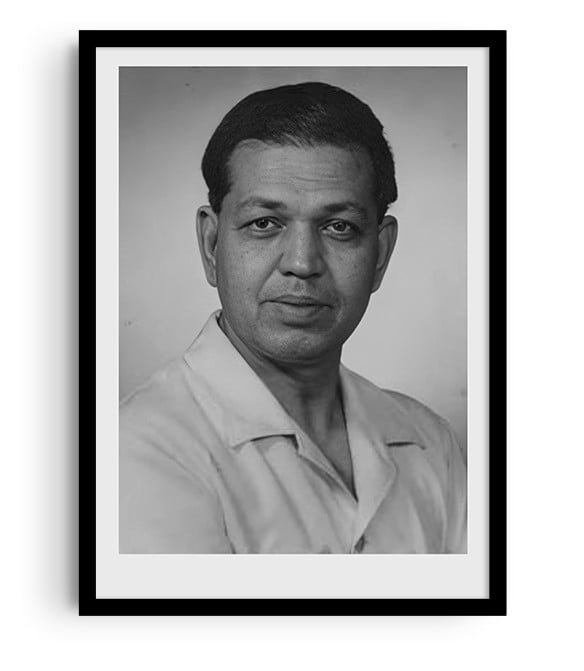

C.D. Deshmukh

1943 - 1949

Background:

The first Indian to serve as RBI Governor, Sir C. D. Deshmukh was an Indian Civil Services officer.

Key Contributions:

During his tenure, he oversaw the partition of India and the subsequent division of assets and liabilities between India and Pakistan.

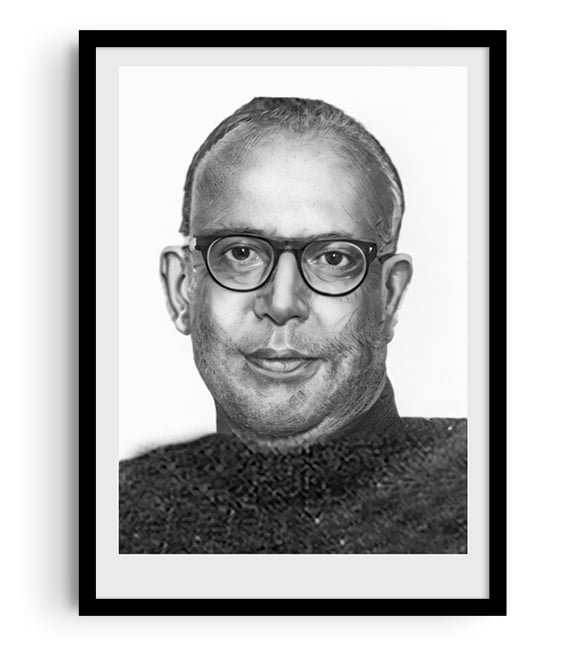

Benegal Rama Rau

1949 - 1957

Background:

An Indian Civil Services officer, Sir Benegal Rama Rau had served as the Indian Ambassador to the United States prior to his governorship.

Key Contributions:

He is the longest-serving RBI Governor, and his tenure saw the consolidation of India's banking sector.

K.G. Ambegaonkar

1957 - 1957

Background:

Formerly the Finance Secretary, K. G. Ambegaonkar served as Deputy Governor before being appointed as interim Governor following the resignation of Benegal Rama Rau.

Key Contributions:

Stepped in as an interim Governor.

H.V.R. Iyengar

1957 - 1962

Background:

An Indian Civil Services officer, H. V. R. Iyengar was the Chairman of the State Bank of India before becoming Governor.

Key Contributions:

His tenure witnessed the transition of Indian coinage to the decimal system.

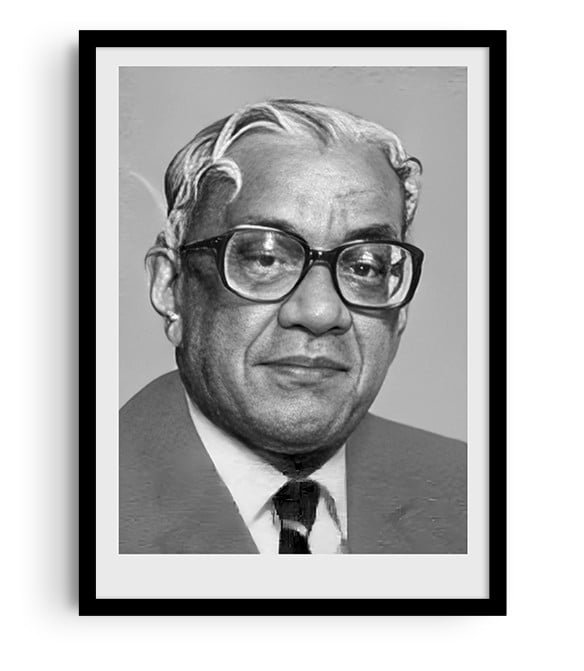

P.C. Bhattacharya

1962 - 1967

Background:

Prior to his governorship, P. C. Bhattacharya served as the Chairman of the State Bank of India.

Key Contributions:

His term focused on strengthening the banking infrastructure in the country.

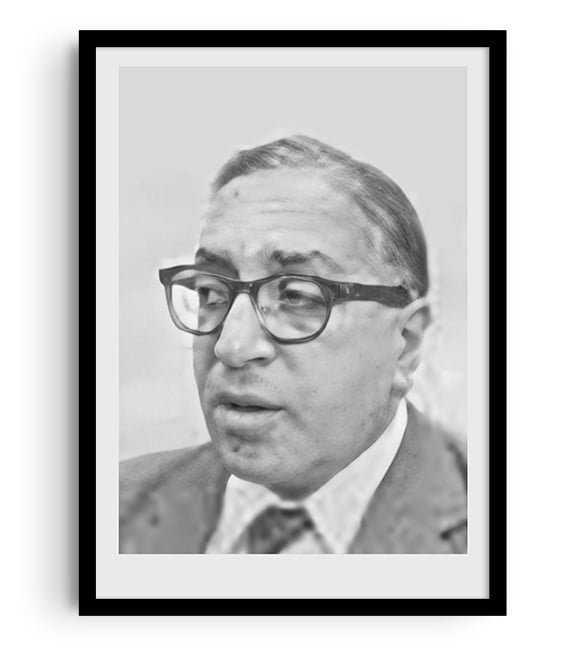

L.K. Jha

1967 - 1970

Background:

An Indian Civil Services officer, L. K. Jha was the Secretary to the Prime Minister before his appointment as Governor.

Key Contributions:

He later served as India's Ambassador to the United States.

B.N. Adarkar

1970 - 1970

Background:

An economist, B. N. Adarkar was the Economic Advisor to the Government before becoming Deputy Governor.

Key Contributions:

He served as interim Governor during his brief tenure.

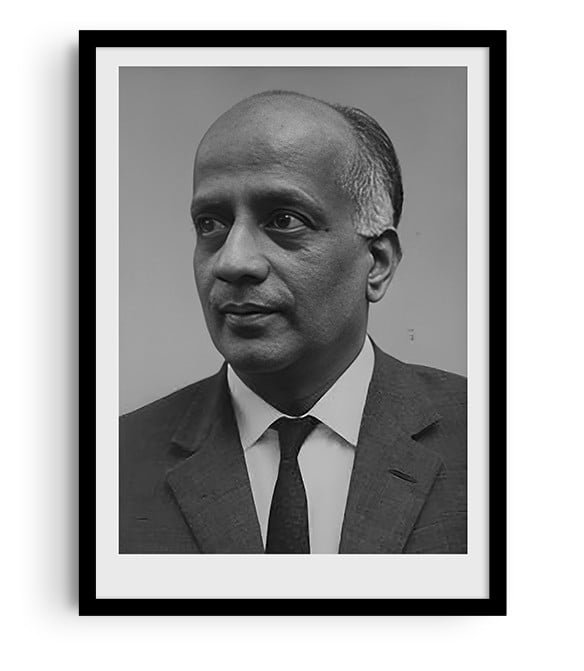

S. Jagannathan

1970 - 1975

Background:

An Indian Civil Services officer, S. Jagannathan had served as India's Executive Director at the World Bank prior to his governorship.

Key Contributions:

He resigned to take up the position of India's Executive Director at the International Monetary Fund.

N.C. Sen Gupta

1975 - 1975

Background:

Before his interim governorship, N. C. Sen Gupta was the Secretary of the Department of Banking in the Ministry of Finance.

K.R. Puri

1975 - 1977

Background:

Formerly the Chairman of the Life Insurance Corporation of India, K. R. Puri's tenure saw the establishment of regional rural banks to support rural credit.

M. Narasimham

1977 - 1977

Background:

Starting his career as an RBI research officer, M. Narasimham served as Additional Secretary in the Department of Economic Affairs before his brief term as Governor.

Key Contributions:

Introduced several policy changes aimed at improving the efficiency of the banking sector.

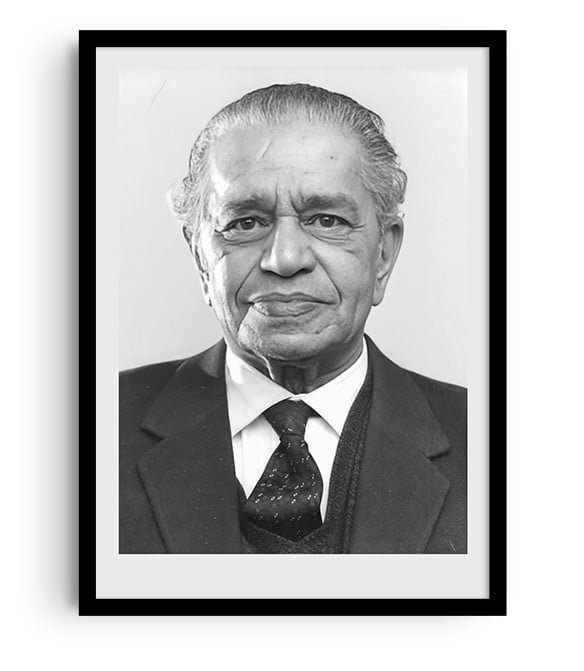

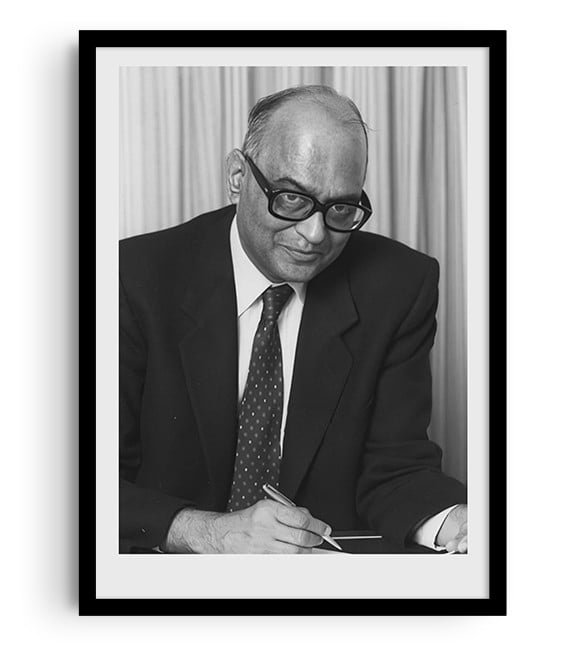

Dr. I.G. Patel

1977 - 1982

Background:

An economist, Dr. I. G. Patel was a Secretary in the Ministry of Finance prior to his governorship.

Key Contributions:

His tenure included the demonetization of high-denomination currency notes in 1978.

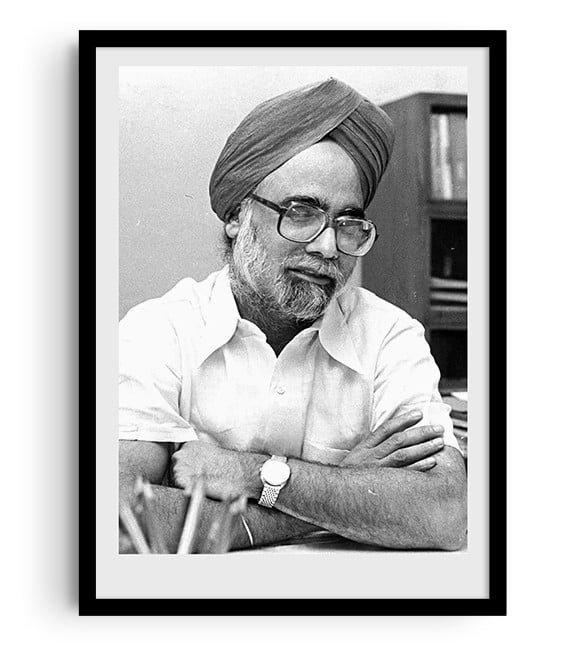

Dr. Manmohan Singh

1982 - 1985

Background:

An economist who later became India's Prime Minister, Dr. Manmohan Singh was the Finance Secretary before his appointment as Governor.

Key Contributions:

His term saw significant legal reforms in banking.

Amitav Ghosh

1985 - 1985

Background:

Serving as Deputy Governor before his interim governorship, Amitav Ghosh's tenure is noted as one of the shortest in RBI's history.

Key Contributions:

Focused on maintaining stability in the banking sector.

R.N. Malhotra

1985 - 1990

Background:

An Indian Administrative Services officer, R. N. Malhotra was the Executive Director at the International Monetary Fund before becoming Governor.

Key Contributions:

His tenure oversaw the inauguration of the Indira Gandhi Institute of Development Research.

S. Venkitaramanan

1990 - 1992

Background:

Prior to his governorship, S. Venkitaramanan served as the Finance Secretary. During his term, India adopted the International Monetary Fund's stabilization program.

Key Contributions:

Played a crucial role in managing the crisis and initiating the economic reforms of 1991.

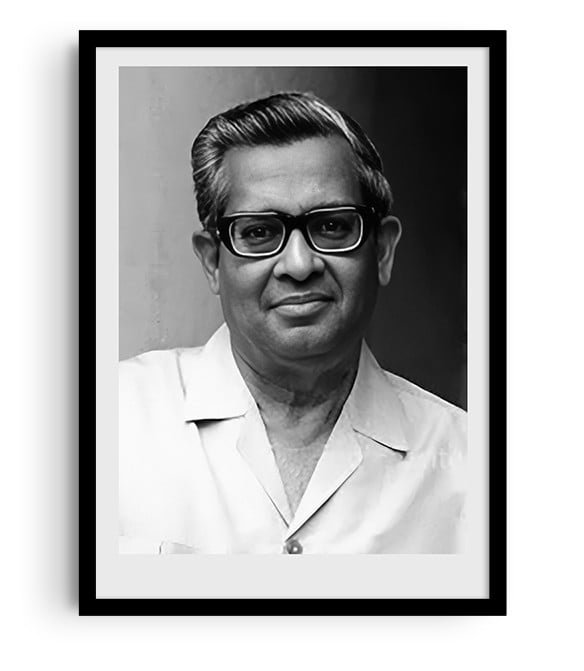

Dr. C. Rangarajan

1992 - 1997

Background:

An economist and former Deputy Governor, Dr. C. Rangarajan's tenure is noted for the establishment of a unified exchange rate system.

Key Contributions:

Introduced several measures to modernize the banking sector and improve financial stability.

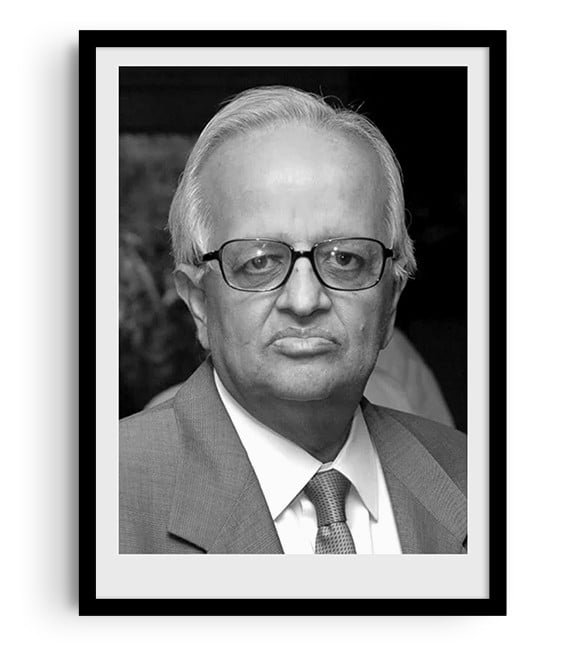

Dr. Bimal Jalan

1997 - 2003

Background:

An economist, Dr. Bimal Jalan held various positions, including Chief Economic Adviser and Finance Secretary, before becoming Governor.

Key Contributions:

Focused on managing inflation and maintaining a stable currency.

Dr. Y.V. Reddy

2003 - 2008

Background:

A seasoned civil servant, Dr. Reddy's tenure was marked by prudence and stability.

Key Contributions:

Implemented measures to insulate India from the global financial crisis of 2008.

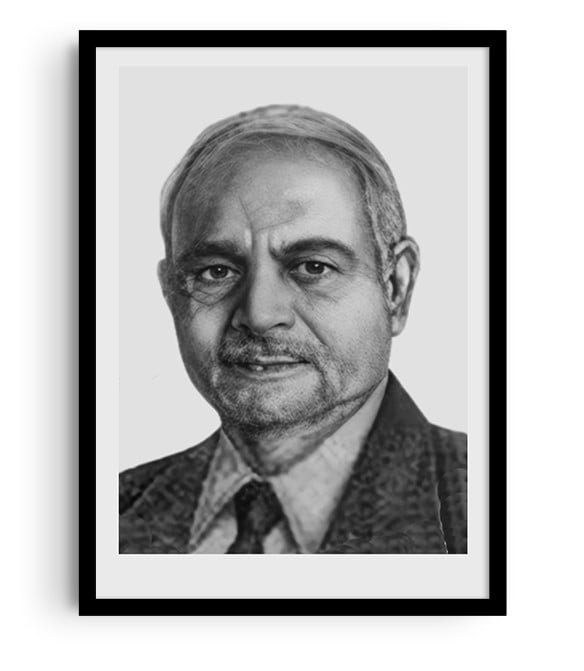

Dr. D. Subbarao

2008 - 2013

Background:

An economist and bureaucrat, Dr. Subbarao took charge during the global financial crisis.

Key Contributions:

Played a key role in navigating the Indian economy through the global financial turmoil.

Dr. Raghuram G. Rajan

2013 - 2016

Background:

An economist of international repute, Dr. Rajan's tenure was marked by significant reforms.

Key Contributions:

Introduced the inflation-targeting framework and focused on cleaning up the banking sector.

Dr. Urjit Patel

2016 - 2018

Background:

An economist and central banker, Dr. Patel's tenure was noted for its focus on inflation targeting.

Key Contributions:

Led the RBI during the implementation of demonetization and introduced measures to strengthen the banking system.

Shaktikanta Das

2018 - 2024

Background:

Shaktikanta Das is a retired Indian Administrative Service (IAS) officer who served as the 25th Governor of the Reserve Bank of India (RBI) from December 2018 to December 2024. Before becoming RBI Governor, he held key positions in the Ministry of Finance, playing a crucial role in policy-making, including the implementation of GST and demonetization.

Key Contributions:

As RBI Governor, he steered India’s monetary policy through the COVID-19 pandemic, ensuring financial stability and liquidity support. His tenure focused on inflation control, digital banking expansion, and strengthening India's financial sector.

Sanjay Malhotra

2024 - Till Date

Background:

Sanjay Malhotra became the RBI Governor in December 2024. He is a 1990-batch IAS officer with a B.Tech from IIT Kanpur and a Master’s from Princeton. Before this, he was India’s Revenue Secretary and also served in key financial roles.

Add comment